How to Apply to the BAC

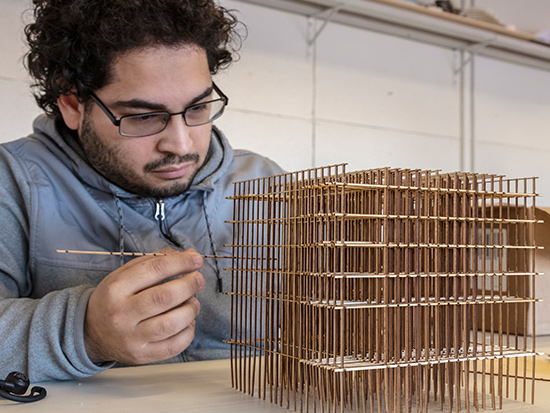

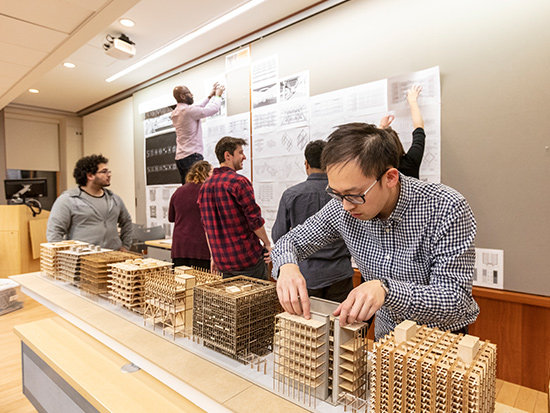

The Boston Architectural College has a policy of open admissions for all of our onsite degree programs, supporting our mission of diversifying the design profession by providing an exceptional design education to many talented students who would not otherwise have such an opportunity. Many of our students are first-generation college students as well as members of under-represented groups, which encourages a positive and inclusive learning environment on our campus in downtown Boston.

When Do I Apply?

You may apply to the BAC’s on-campus programs at any point throughout the year as we review applications and offer admissions decisions on a rolling basis. (Please note that the College’s highly selective online programs have different admissions parameters and deadlines.)

However, if you would like to be considered for scholarships and awards for our programs, please apply by these scholarship deadlines:

February 15 = fall semester

October 15 = spring semester

Application Requirements

Please select your type of program or enrollment to see the BAC’s application processes and get your questions answered:

617.585.0123